Best interview questions for your hiring process

Insurance Agent Interview questions

Insurance Agents are a key part of any insurance provider. They will contact potential customers to offer deals and packages, or to upsell new features or services to existing customers.

These are the important qualities to look for in an Insurance Agent:

- Excellent negotiator

- Confident telephone presence

- Rapid problem-solving skills

- Ability to work to targets

- Skilled with Microsoft Office and/or a CRM

Interviewing an Insurance Agent

An Insurance Agent is an essential hire for any insurance provider looking to grow their customer base, improve sales, or upsell new packages and features. As this role will have a direct impact on sales, you need to properly ensure you’ve got the right person for the job!

That’s why we’ve put together these example questions for use during your interview process. These example Insurance Agent interview questions will test the relevant skills of your candidate and make your decision easy.

How to open the job interview

While Insurance Agents will be strong communicators with excellent people skills, an interview is still bound to make them nervous. So, to combat this, it is important that you work to put them at ease.

This can be done by asking a couple of laid-back opening questions.

Best interview questions for your hiring process

See our Insurance Agent job description hereFor the interview

A positive opener to start

What has been one of your favourite moments when working as an Insurance Agent?

Why did you choose a career in insurance?

Behavioral Questions

Name a time you overcame a very difficult sell?

Tell me about a time when you had to deal with a rude or stand-offish customer. What did you do?

Unfortunately, not every call an Insurance Agent deals with will be pleasant. Here you’re looking for a candidate who keeps cool, calm, and professional when faced with these types of situations.

Tell me about a time a customer asked you a tough question, how did you deal with this?

An Insurance Agent won’t always have every answer. Here you are looking for examples that the candidate thought on their feet. If they asked a colleague for assistance or checked the company guidebook these are good signs!

Talk me through a time when you and a manager have disagreed on the way something was done.

Here, you’re looking for professionalism. The debate should have been solved in a professional way, with your candidate giving expert knowledge on why they think their point was correct.

Soft Skills

How do you ensure you are giving adequate attention to a customer when working to an extremely tight schedule?

Even during busy shifts, an Insurance Agent needs to provide a good level of customer service to each customer. Therefore, your candidate should mention some prioritisation techniques they use during this situation.

What steps would you take if a customer mentioned they weren’t happy with your service?

Here, a candidate should take the initiative to turn this feedback into actions. They should then use these actions in future calls, to ensure improvement in their work.

What skills do you have that help you succeed as an Insurance Agent?

Here a candidate can list their confidence areas and any soft or hard skills that they believe helps them within this role.

When explaining a difficult insurance service or complex insurance term to a potential customer, how do you ensure they understand what you’re saying?

This, again, tests a candidate’s communication and people skills. They should mention some techniques, such as using comparisons, real-world examples, and giving the customer time for questions.

Hard Skills

What is the most difficult product you’ve worked with during your sales career?

This question aims to gain more understanding of a candidate’s skill to explain and sell complex products. As an Insurance Agent may sometimes have to detail legal technicalities, this is a useful skill for them to hold.

How comfortable are you with writing or editing scripts for colleagues to use?

This won’t always be necessary, but if a script is used within your business, it is good to know your candidate can make improvements to this for future colleagues.

Which languages can you fluently work with customers in?

In international or expanding businesses, a candidate fluent in multiple languages is a great advantage.

Have you received any formal training within the insurance or sales sectors?

Here, you will get an idea of whether a candidate brings any certifications to your business.

Do you have experience within any specified insurance areas?

If you offer multiple insurance types, knowing if a candidate has experience in any specialised insurance areas (e.g. house insurance or pet insurance) is extremely useful.

Operational / Situational Questions

If a customer or client asked a question that you didn’t know the answer to, what would your next steps be?

Here, a candidate should take steps to assist the customer with the knowledge and tools they have. They may check a guidebook, or an FAQs database, or pass the customer over to a colleague with more knowledge in this area.

If you made a sale to a customer, only to receive a complaint about this sale at a later date, what would you do?

Here, a candidate should ensure they fully understand what has gone wrong in this scenario. This will involve investigating the case, reading or listening to the customer’s complaint, and working to understand what service may have been better suited to this individual to avoid similar situations in the future.

Imagine you were experiencing a quieter moment at work, but noticed a colleague struggling with multiple calls, what would you do?

Your candidate should be a team player, and offer to take a call off of a colleague’s hands if possible. Working with a line manager to avoid this situation in the future is also a good sign.

If you were to join our team as an Insurance Agent, what would your first actions be?

Here, you’re looking for a candidate who gets to know their team, the way your business operates, and the product you offer. Taking in as much information as possible will mean a smoother onboarding.

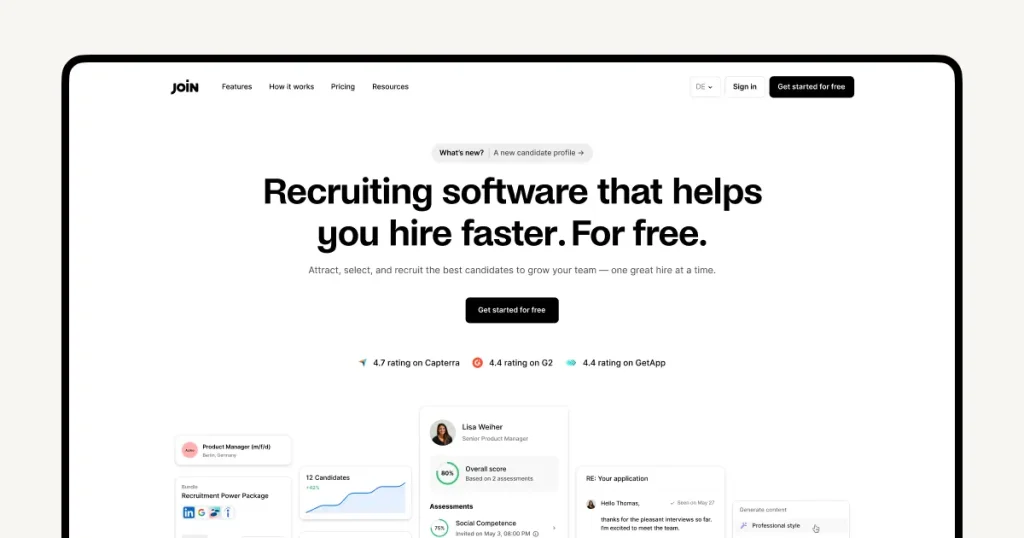

Start hiring and prepare your interview

All platforms are available for you to promote your job through JOIN.

Create job ad for free

Not every customer will be an easy sell, so knowing your potential Insurance Agent can overcome challenges like this by using certain sales and communication techniques is really important.